Trade With Me

-

Ali Moin-Afshari,

with the Quant Systems Team -

Level: Advanced Beginner to Advanced Price Action Traders

Write your awesome label here.

Course overview

A 10-month hands on training program for advanced beginner and intermediate traders with a focus on day trading futures markets.

-

Step-by-step videos

-

Skill building from beginner to advanced

-

Fill your knowledge gaps

-

Fix your trade execution issues

-

Day trading techniques

-

Advanced Techniques

-

Multi-time frame market analysis

-

Hands-on live trading

-

Pre- and Post-session support

-

and more...

January 2026 Live Session Date

What is TWM

Meet Your TWM Team

Ali Moin-Afshari

Author of TWM Program,

Systematic Trader

Systematic Trader

ABOUT ALI

Ali Moin-Afshari is the founder of Quant Systems and author of the TWM program. He will be live trading during the hands-on sessions of TWM.

Brad Wolf

SA2 and TWM Coach,

Professional Trader

Professional Trader

ABOUT Brad

Brad Wolf is a professional price action trader and educator. He has been coaching Quant Systems Systems Academy 2 students since 2023. Brad has contributed to the development of the TWM program and will be teaching and supporting you in the live trading and Q&A sessions.

James Regan

SA2 and TWM Coach,

Systematic Trader

Systematic Trader

ABOUT James

James Regan is a systematic trader, programmer, and educator. He has been coaching Quant Systems Systems Academy 2 students since 2023. James has contributed to the development of the TWM program and will be teaching and supporting you in the live trading and Q&A sessions.

Faizal Merali

TWM Program Manager

Systematic Trader

Systematic Trader

ABOUT Faizal

Faizal is Quant Systems PTM and TWM program manager, a SA2 graduate, and a fulltime trader. He has contributed to the development of the TWM program and will be supporting you and managing TWM live sessions.

Why enroll in TWM

How will TWM fix these issues

You asked for TWM...

What is Expected of You

Frequently Asked Questions

When does the program start, and how long does it run?

TWM program launched in September 2025. Each month is dedicated to one of 10 core first principles of market behavior — the foundational concepts that underpin professional-level trading. You’ll first learn the principle, then have time to practice and internalize it, and finally watch Ali execute in real time with that specific principle as the focal point. This structure ensures that every concept is both deeply understood and grounded in live market application.

TWM is not a cohort based program, so you can join at any point in time. You will receive the courseware plus 10 live trading sessions and 10 live Q&A sessions, for 10 months.

If you are a full member, you will have access to the courseware after the 10 months has expired.

TWM is not a cohort based program, so you can join at any point in time. You will receive the courseware plus 10 live trading sessions and 10 live Q&A sessions, for 10 months.

If you are a full member, you will have access to the courseware after the 10 months has expired.

Can I join TWM at any time?

Yes, TWM courseware is separate from live trading. You can join anytime and go through the program at your own pace. You will get the courseware plus 10 live trading and 10 Q&A session.

Will Ali be narrating his thought process while trading?

Yes. You’ll get direct access to Ali’s live market commentary, where he walks you through what he’s seeing, thinking, and doing — in real time. You’ll also benefit from the support of our coaching team, Brad Wolff and James Regan, who will actively answer questions and provide trading insights during the trading day. Post-market Q&A sessions will also be held to deepen your understanding.

What happens if I miss a live session?

No problem at all. Every session — including Ali’s live trades, real-time commentary, and post-market Q&As — will be fully recorded and uploaded for on-demand access. Whether you're in a different time zone or simply can’t make it live, you’ll be able to watch, re-watch, and study each session at your own pace.

Why is Ali trading the minimum position size?

Ali will be trading 1 micro contract, with the option to scale in 2–3 times if the setup justifies it. The focus isn’t on size — it’s on process and execution. This is about showing you what’s possible when you have the right tools and a repeatable process — not about showing off. It’s about demonstrating what’s achievable with skill and discipline — even with the smallest position size.

I have already bought other Quant Systems products. How is this different?

While our other programs focus on teaching systems and theory, Trade With Me brings those principles to life. Not only do you get a structured education on the first principles of market behavior, but you also get the rare opportunity to see those principles applied under live market conditions — and how a full-time trader manages uncertainty, reads context, and makes decisions — all in real time.

Can we ask questions outside of the live trading sessions and Q&A?

All questions must be submitted during the trading session or the live Q&A session.

Is this suitable for newer traders?

Trade With Me delivers a comprehensive education that covers everything from reading price action, identifying setups and entries, trade management, to deeply understanding market structure and behavior. You don’t need to be advanced, but you do need to be serious. This program is designed to accelerate your growth by giving you access to what most traders never experience: live, professional-level execution.

Are the topics covered in TWM same as those in the Pro Trader Mentoring program?

Price action is price action. Topics are the same but organization, approach, and presentation are different. TWM has more detail and lots of detailed charts. We don't have that opportunity in PTM to search for the perfect example because the session is live, but we can when producing videos.

PTM's discussions are customized to the current market, which is what we cannot do in TWM. But TWM had more detailed slides and charts, which we cannot do in PTM due to the restraints of a live session.

The kind of detail we can go into is different. In PTM students direct the direction of conversation based on their questions. In TWM the program's detailed syllabus sets the course. TWM has a great emphasis on execution, but PTM does not.

Which program is more suitable for me?

For beginners, PTM is the best Quant Systems program. We constantly see gaps in students knowledge that go back to basic concepts. So, if you want to lay a solid foundation and it is still too early for you to trade every day, Pro Trader Mentoring is where you want to be.

For more advanced traders who need the experience of watching a professional trader analysis and trading in live markets, TWM is better because the courseware covers the concepts with detailed videos that should address any gaps in their knowledge but it also provides the hands on training that is missing from most trader development programs.

For advanced intermediate and systems oriented traders, Systems Academy 2 (SA2) program is more suitable. These traders want to work with a coach over a longer period of time in a small group to develop systems, ask lots of questions, and get personalized feedback and answers.

We have a lot of our current SA2 students and SA2 alumni signing up for TWM, because they understand the value it offers in its hands on trade execution part. These are the same group of people who have been asking for TWM for two years now.

For more advanced traders who need the experience of watching a professional trader analysis and trading in live markets, TWM is better because the courseware covers the concepts with detailed videos that should address any gaps in their knowledge but it also provides the hands on training that is missing from most trader development programs.

For advanced intermediate and systems oriented traders, Systems Academy 2 (SA2) program is more suitable. These traders want to work with a coach over a longer period of time in a small group to develop systems, ask lots of questions, and get personalized feedback and answers.

We have a lot of our current SA2 students and SA2 alumni signing up for TWM, because they understand the value it offers in its hands on trade execution part. These are the same group of people who have been asking for TWM for two years now.

Do you guarantee I will become consistently profitable? What about your past students?

It would be insincere for us to guarantee results when we cannot control a lot of factors that affect those results. You are the biggest factor in creating results. So, instead of asking us, it is better to look inside yourself. Have you been successful in the past in following a long program, like pursuing a university degree? What happened then? How did you overcome obstacles? What did you do to develop skills based on instructions you were given?

What we can guarantee however, is that we will show you what works in both theory and practice. The rest is up to you, to choose what you will focus on to implement and how you will develop your own technique so that it fits you best.

As for past students, please feel free to review our testimonials on the links below:

What we can guarantee however, is that we will show you what works in both theory and practice. The rest is up to you, to choose what you will focus on to implement and how you will develop your own technique so that it fits you best.

As for past students, please feel free to review our testimonials on the links below:

Do you provide any indicators?

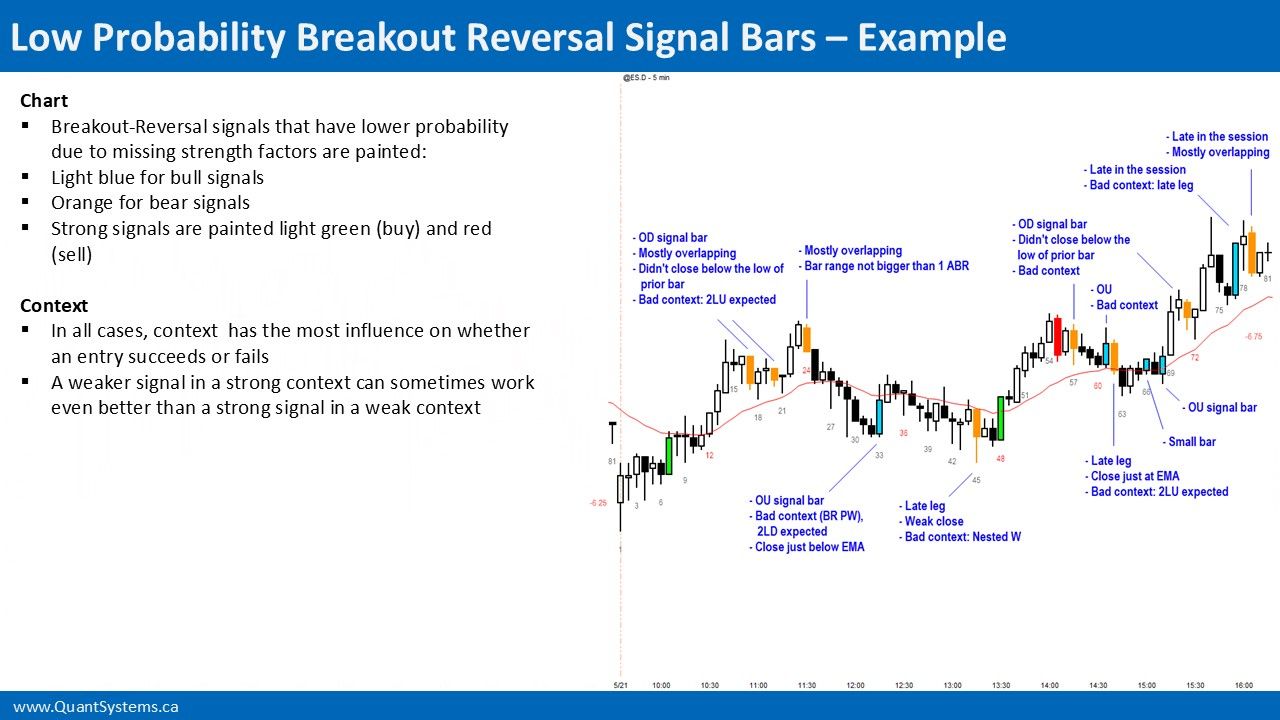

Yes, the latest version of Ali's Breakouts Paint Bar indicator (AMA_Breakouts_PB) is included in different code varieties to run on TradeStation, Multi Charts, Ninja Trader, and Trading View.

Does TWM teach systematic trading?

Ali's approach to trading is a systematic approach but TWM is not a systems development course. The systems concepts are not suitable for the majority of the traders because many do not have the prerequisites, such as a higher education degree, longer trading experience, a quantitative background, etc. For that reason, Quant Systems Systems Academy 2 program has an admission process that selects candidates who are a good fit for that program.

TWM presents the concepts based on Ali's view of the markets that is a little different from both conventional technical analysis and Dr. Brooks' price action work. His approach is more systematic and step-by-step and less discretionary. TWM is designed to teach traders to think of price action in terms of a machine that functions in a repetitive and predictive way. The focus is on identifying repeatable edges first, then learn about nuances, and proper implementation technique.

This is not system development however, as a systematic trader needs specialized training. They follow the same approach of identifying edges that are repeatable, but the way they implement them is different and has a lot more research, rigor, and math to support it.

This is not system development however, as a systematic trader needs specialized training. They follow the same approach of identifying edges that are repeatable, but the way they implement them is different and has a lot more research, rigor, and math to support it.

What are the live trading hours?

9 AM to 5 PM EST. We will start half an hour before the start of the session which is at 9:30 AM EST and finish by 4 PM EST with a review of the day following the trading session.

Are the concepts taught applicable to other markets?

Yes they are. Price action trading follows the principle of invariance (which you will learn in TWM), it means the market behavior you see on ES futures will be seen in any other market that is traded with enough volume, in other words is a liquid market.

Can I use the PaintBar on charts of other markets?

Yes you can and it works in exactly the same way. The paint bar Ali wrote works based on principles of price action and it will work in other markets in the same way it does on ES futures charts following the principle of invariance (which you will learn about in TWM).

How long will I have access to the course material?

If you are a full or founding member of TWM there is no time limited access, so you will have access to TWM courseware as long as Quant Systems and the Internet exist. Founding members are those who signed up before the official launch of the program.

We might announce other types of TWM membership offers over time that might have a time-limited or subscription based access.

We might announce other types of TWM membership offers over time that might have a time-limited or subscription based access.

Do you have a refund policy?

We DO NOT have a refund policy.

It is partially to protect our high value content and the immense amount of time and cost that goes into bringing this program to you and partially to weed out people who are not sure of themselves - the tire-kickers.

TWM is for the serious trader, not a beginner. You know this is right for you, if you are the right type of candidate.

It is partially to protect our high value content and the immense amount of time and cost that goes into bringing this program to you and partially to weed out people who are not sure of themselves - the tire-kickers.

TWM is for the serious trader, not a beginner. You know this is right for you, if you are the right type of candidate.

How can I try TWM before I enroll?

We might announce low cost paid trials from time to time. If one is available, you will see the option on the enrollment page. Click on the sign up button and follow the link.

How do I manage my Quant Systems account?

You can log into your unique Stripe portal using this link.