Mar 26

/

Ali Moin-Afshari

Day Trading Live in Front of 100+ People

In this post, I am going to share some of my experiences from participating in our 2022 Orlando Trading Workshop, presenting and trading alongside my mentor, Dr Al Brooks.

I believe my experiences from live day trading in front of a large audience and side by side with one of the greatest traders ever, is quite educational for developing traders.

I believe my experiences from live day trading in front of a large audience and side by side with one of the greatest traders ever, is quite educational for developing traders.

Preparing the 2022 Workshop

Al, Richard (BTC admin), and I worked as team for several months leading up to the Orlando workshop to prepare the event. The amount of work necessary to prepare an event is absurd compared to how long the event itself takes. The whole thing was over in three days but we had to work on it for months.

My Goals for the Workshop

If you have listened to me for a little while, you already know that I think the single most important concept in trading is understanding breakouts. The market is a two dimensional phenomenon. Price can either stay put or move. When it moves it creates breakouts. All analysis is really based on the quality of the breakout. There are many quantifiable factors in deciding on the quality. So, it is fairly straightforward to calculate the probability of follow-through of a new breakout based on these factors.

My single most important goal was to pass that knowledge on to the participants during my presentation on the first day of the event and to demonstrate the effectiveness of breakout analysis during the live trading days, and further enhance the learning by sharing my own research with everyone. You can find the research on this website, here.

Since breakout is the most fundamental principle of market behavior, it is foundational to understanding everything else. I was hoping to give everyone a good foundation, reinforced and enhance by research and live trading demonstration, to help them see they don't need much else to become consistently profitable. Essentially, just focus on learning breakouts and you should be good to go.

My secondary goal was to be just me and break the heroism people associate with successful day trading. To challenge the notion or the aurora of super human ability of a trader that in the minds of beginners is so desirable yet seems impossible to achieve.

My single most important goal was to pass that knowledge on to the participants during my presentation on the first day of the event and to demonstrate the effectiveness of breakout analysis during the live trading days, and further enhance the learning by sharing my own research with everyone. You can find the research on this website, here.

Since breakout is the most fundamental principle of market behavior, it is foundational to understanding everything else. I was hoping to give everyone a good foundation, reinforced and enhance by research and live trading demonstration, to help them see they don't need much else to become consistently profitable. Essentially, just focus on learning breakouts and you should be good to go.

My secondary goal was to be just me and break the heroism people associate with successful day trading. To challenge the notion or the aurora of super human ability of a trader that in the minds of beginners is so desirable yet seems impossible to achieve.

Sharing the stage with my mentor, Dr Brooks

My final goal was to enjoy the event as a participant - just like everyone else. Some of my Systems Academy students were participating too, and I was eager to spend some time with them and with other people who I had worked with remotely, like Richard and Brad Wolff, but had not met them in person yet.

With some of my Systems Academy students during the informal meet and greet evening before the start of the 2022 Orlando Workshop

It was so good to see my students in person and share some quality time with them. I see them every week on Zoom but being in the same room with them was a completely different experience.

Preparing for the Day

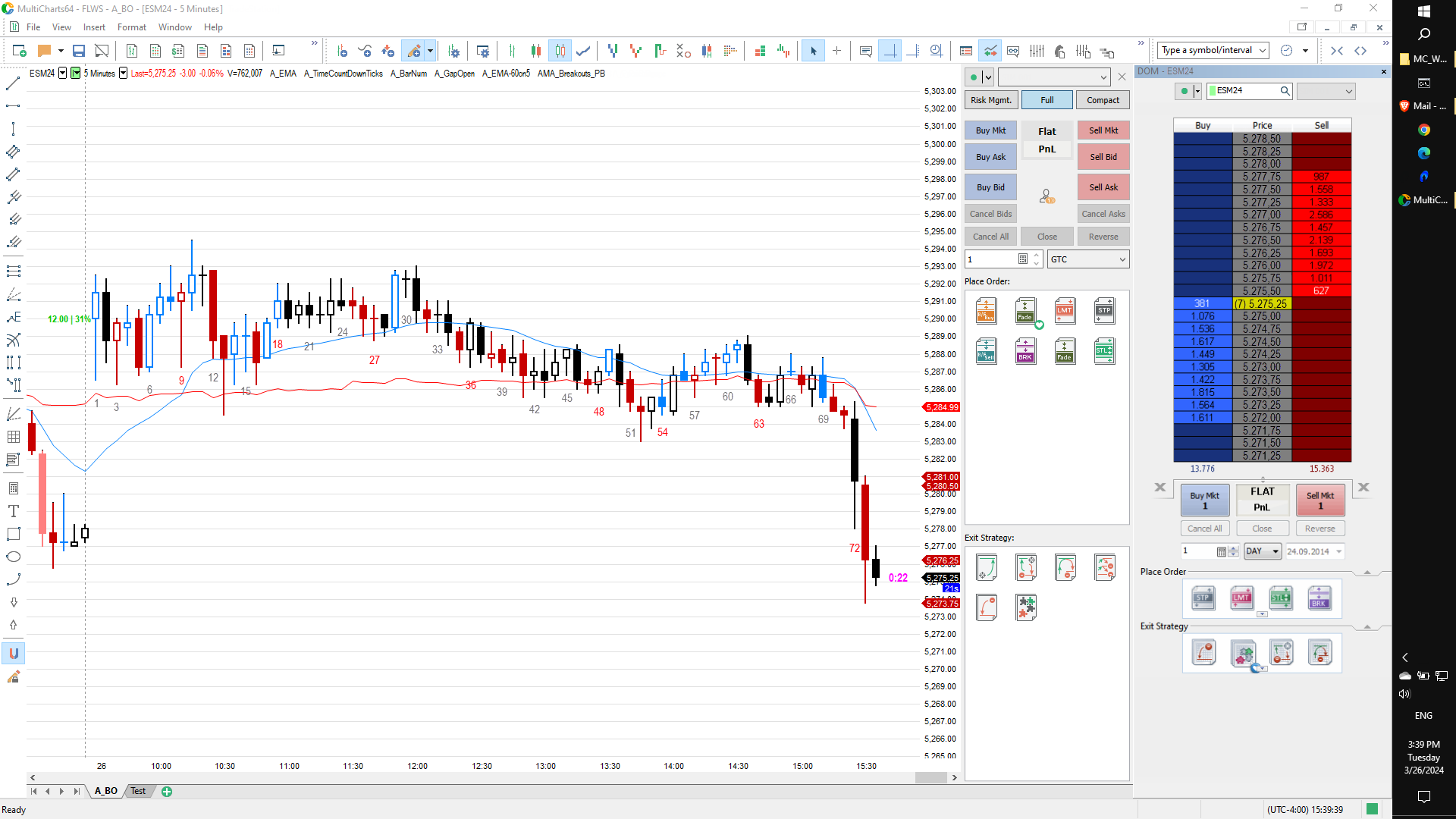

When I am working from my home office, everything is set up and ready for trading, but in a conference I had to work on a laptop. At home, I use a single 48 inch 4K monitor connected to my work laptop. I had to prepare a new desktop for MultiCharts (the trading platform I use for trade execution) to fit my laptop's 15 inch HD screen. Here is how the screen looked like, below (chart is from the day I am writing this blog post).

My typical trading desktop has other charts from higher timeframes (15 min, 45 min, and daily) and one timeframe lower chart (100 seconds) but it was not possible to place all those charts on a single 15" HD screen in addition to the price ladder and order management windows. So, I had a second laptop with those charts on it.

We had two desks on the stage on both sides of the podium to put our laptops on, with me on the right and Al on the left, both facing the audience. Our laptop screens were duplicated on the big screens for the audience to see them.

We had two desks on the stage on both sides of the podium to put our laptops on, with me on the right and Al on the left, both facing the audience. Our laptop screens were duplicated on the big screens for the audience to see them.

My Typical Work Day at Home

On any typical trading day, I get something light to eat and take a mug of tea or coffee with me to my office and start trading. There is really nothing special about it. I don't meditate or do any kind of exercises, etc. But there is one important thing.

I have a rule that everyone knows: you can't talk to me before my work day.

I just say hi and that is it. Everyone knows that I like a quite morning and am not interested in discussing anything until after work. This is because I want to keep my mind fresh. I don't want to use up my energy problem solving for the family or let them put ideas in my head.

When you are presenting in a workshop, people constantly have questions. I was worried that I might not get my typical quiet morning while in Orlando. So, I thought I will show up right at the start of the day, but not earlier, to skip possible morning conversations with the audience. I knew that Richard and Al and other team members were there to answer any questions people might have.

Interestingly, some people were offended that I was not on the stage before the market open. Strangely enough, they never asked why. We learned later on, when we asked for audience feedback.

These events are meticulously planned. Even a simple everyday thing like someone seemingly arriving late is probably not a coincidence but rather pre-planned.

The message here is clear: If there is anything you don't understand please ask instead of assuming you already know the answer. It might be an opportunity for you to learn something.

I have a rule that everyone knows: you can't talk to me before my work day.

I just say hi and that is it. Everyone knows that I like a quite morning and am not interested in discussing anything until after work. This is because I want to keep my mind fresh. I don't want to use up my energy problem solving for the family or let them put ideas in my head.

When you are presenting in a workshop, people constantly have questions. I was worried that I might not get my typical quiet morning while in Orlando. So, I thought I will show up right at the start of the day, but not earlier, to skip possible morning conversations with the audience. I knew that Richard and Al and other team members were there to answer any questions people might have.

Interestingly, some people were offended that I was not on the stage before the market open. Strangely enough, they never asked why. We learned later on, when we asked for audience feedback.

These events are meticulously planned. Even a simple everyday thing like someone seemingly arriving late is probably not a coincidence but rather pre-planned.

The message here is clear: If there is anything you don't understand please ask instead of assuming you already know the answer. It might be an opportunity for you to learn something.

Group photo with Dr Brooks and our team on the final day of workshop

From left to right: Faizal, Brad, Richard, Robert, me, Al, and Tim

My Experience and Observations

When I began looking at the chart to start trading, I knew there was an audience who were watching me. It initially took away from my focus, but as I began analyzing bars and thinking about the price action the effect began to disappear. At some point during the day, I woke up and realized I am in the conference room with Al and all those people.

This is the same experience soldiers talk about when they tell their war stories. They are apprehensive of the fact that they are going to war and even afraid. But when the action starts, their training kicks in and their focus shifts to the task at hand.

Day traders are mostly private individuals. The focus trading requires usually prevents them from socializing during work. I, for example, would be bothered if there is someone else in my office even though they are sitting there quietly. I want a controlled environment customized to my liking to be comfortable. Yet, in the very different environment of the Florida Hotel's conference center, with an uncomfortable iron chair, I forgot about my surroundings when trading began.

I had not realized up to that point, how profound that effect can be. Once I began trading the world around me shrank and disappeared. There was me and the familiar chart and the same old familiar mouse.

The interesting thing is the effect of the environment on the first one or two trades of the day. On both trading days I had losses at the beginning (see P&L graphs below) and now that I think about it, I can see they were partially due to my focus not being fully on my work yet. That is like the common thing you hear from veterans, "if you are not hit as you step out of the chopper, you have a chance", which is like saying if you survive the first encounter with the enemy (if you're not ambushed) you can fight back.

So, it make sense to initially trade smaller until your training kicks in and you are 100% focused on the task and are trading in the now.

This is the same experience soldiers talk about when they tell their war stories. They are apprehensive of the fact that they are going to war and even afraid. But when the action starts, their training kicks in and their focus shifts to the task at hand.

Day traders are mostly private individuals. The focus trading requires usually prevents them from socializing during work. I, for example, would be bothered if there is someone else in my office even though they are sitting there quietly. I want a controlled environment customized to my liking to be comfortable. Yet, in the very different environment of the Florida Hotel's conference center, with an uncomfortable iron chair, I forgot about my surroundings when trading began.

I had not realized up to that point, how profound that effect can be. Once I began trading the world around me shrank and disappeared. There was me and the familiar chart and the same old familiar mouse.

The interesting thing is the effect of the environment on the first one or two trades of the day. On both trading days I had losses at the beginning (see P&L graphs below) and now that I think about it, I can see they were partially due to my focus not being fully on my work yet. That is like the common thing you hear from veterans, "if you are not hit as you step out of the chopper, you have a chance", which is like saying if you survive the first encounter with the enemy (if you're not ambushed) you can fight back.

So, it make sense to initially trade smaller until your training kicks in and you are 100% focused on the task and are trading in the now.

Live Trading Day 1

Watching Al

I finally had my wish come true, to trade with Al in the same room, so I wanted to take advantage of the opportunity to the fullest, even though I was trading actively myself, too.

I occasionally turned to my left to look at him. He was the example of focus, sitting there with one leg lucked beneath him on the chair, holding the mouse, looking at his chart, and not moving. Every time I looked he was in the same position, as focused as an hour ago. That, in my opinion, is quite admirable.

I occasionally turned to my left to look at him. He was the example of focus, sitting there with one leg lucked beneath him on the chair, holding the mouse, looking at his chart, and not moving. Every time I looked he was in the same position, as focused as an hour ago. That, in my opinion, is quite admirable.

Questions and Interruptions

On the first day of trading, we let people ask their questions during the day.

It proved for both Al and I to be quite disruptive. I prefer a quiet room to work in and questions were a major source of interruption. Every question gives you a little problem to solve, because you have to consider how best to explain the answer for them to understand it. If you have an idea of the skill level of the person asking the question, for example from earlier interactions with them, then there is more information to process because you would want to customize the answer to their skill level.

Remember what I said about wanting quiet mornings? It was apparent to both Al and I that questions have to wait until after the close. And that is what we did on the second day of trading, asking everyone to write down their questions and ask them after trading is finished.

It proved for both Al and I to be quite disruptive. I prefer a quiet room to work in and questions were a major source of interruption. Every question gives you a little problem to solve, because you have to consider how best to explain the answer for them to understand it. If you have an idea of the skill level of the person asking the question, for example from earlier interactions with them, then there is more information to process because you would want to customize the answer to their skill level.

Remember what I said about wanting quiet mornings? It was apparent to both Al and I that questions have to wait until after the close. And that is what we did on the second day of trading, asking everyone to write down their questions and ask them after trading is finished.

Live Trading Day 1

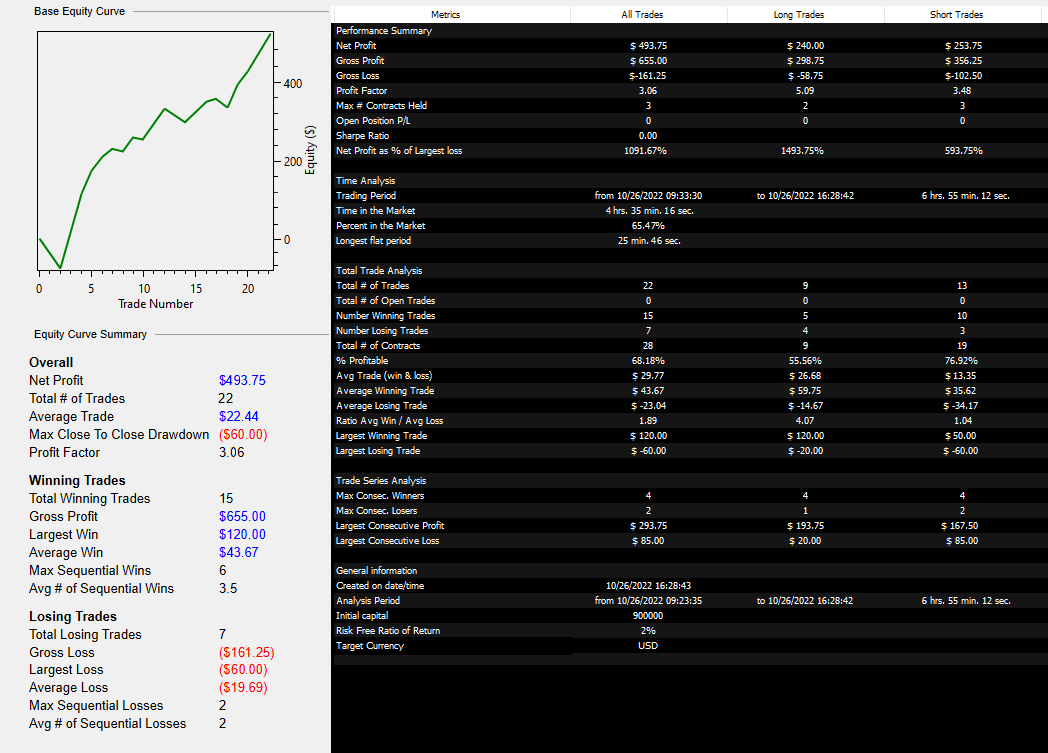

Here is the 5 min chart of the first day of trading, October 26, 2022. The paintbar indicator is the one I wrote for identifying strong breakouts and gave a copy of it to everyone attending, along with a copy of my research whitepaper it is based on.

Day 1 was a classic TTRD (Trending Trading Range Day) with a trading range open that led to the first swing of the day. In October 2022, the market was bearish on higher timeframes and that led to the day forming almost a complete reversal back to the open of the session.

I tried to take as many scalps based on breakouts as I could. I was trading one micro e-Mini contract with scaling in and out style of trade management. You can see my performance report of day 1, below. Dr Brooks' focus was on swing trading.

I tried to take as many scalps based on breakouts as I could. I was trading one micro e-Mini contract with scaling in and out style of trade management. You can see my performance report of day 1, below. Dr Brooks' focus was on swing trading.

My P&L report for day 1

Live Trading Day 2

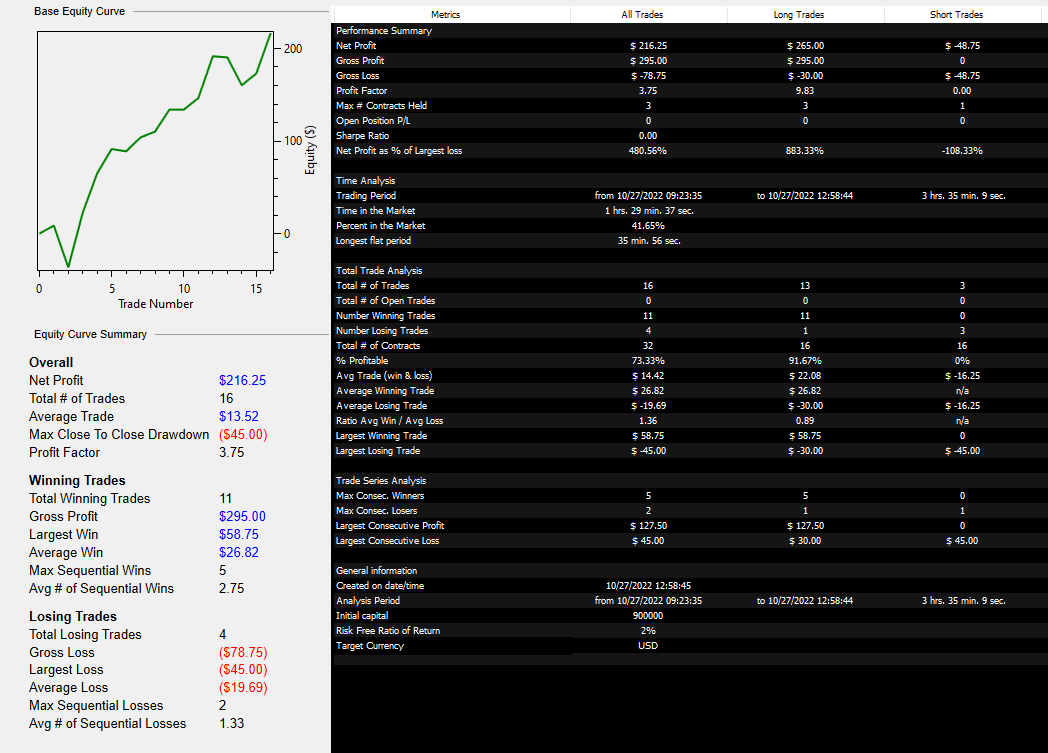

Here is the 5 min chart of the second day of trading, October 27, 2022.

The second day was a short day, ending at 2 PM EDT. I had a brief presentation in the afternoon about human factors and psychological issues affecting trading success with extra time to answer everyone's questions.

This day began with two reversals forming an expanding triangle on the open then sold off for the rest of the day, following the higher timeframe market regime. I pointed out during the session as the market was going up that the bull leg has low probability of getting follow-through. This is one of the common beginner traps for this kind of a TTRD day structure. Basically, to over simplify, there is a strong breakout in the first hour that does not give scalpers any opportunity to enter with limit orders and becomes a vacuum test of support or resistance, before the big reversal begins.

This day began with two reversals forming an expanding triangle on the open then sold off for the rest of the day, following the higher timeframe market regime. I pointed out during the session as the market was going up that the bull leg has low probability of getting follow-through. This is one of the common beginner traps for this kind of a TTRD day structure. Basically, to over simplify, there is a strong breakout in the first hour that does not give scalpers any opportunity to enter with limit orders and becomes a vacuum test of support or resistance, before the big reversal begins.

My P&L report for day 2

My approach was the same as day 1, take as many scalps as I can based on breakouts. Dr Brooks' focus was high frequency scalping trying to achieve a high win rate, basically not having any losses bigger than a few ticks and certainly no big losses.

Behind the Scenes

As I said, a lot goes on behind the scenes. Richard and Robert plus Brad, Faizal, and Tim did such a great job of making sure everything ran smoothly for everyone. Without them the workshop would not have been the success it was.

Richard and Robert working with the Florida Hotel staff to

prepare the conference room prior to the start of the event

With Richard (left) and Robert (right) behind the A/V desk

Final Thoughts

In summary, I think:

Wishing you great success.

Ali.

- Having a good team to support you is critically important to achieve success. This includes developing new skills, too. Who you learn from and how much they care about your progress makes a big difference in both the process of obtaining those skills and in the quality of the skills acquired. The above event would have not been possible without everyone pitching in.

- Day trading is a motor skill. It needs a deep understanding of market behavior and yourself, in addition to forming automatic responses so that you can execute without much active thinking.

- When those skills are learned you can trade under almost any conditions. Your training kicks in and sweeps away the stress of the environment.

- For me personally, it was a great honor to be able to share a stage with my mentor and then to trade alongside him.

- Who could've thought I will be in this position a decade and a half ago when I began learning trading. Over the course of my development there have been many days when I thought this is it - there is no hope for me doing this! But I chose to push it a little more, a little longer, a bit harder, and over time you overcome the obstacles. The key is not to give up and to trade so small that you won't lose your account or damage your psychology, giving yourself time to become good. You can read more on how to become a professional trader, here.

Wishing you great success.

Ali.

Who we are

We are active professional traders committed to producing effective and high quality educational material for intermediate to advanced traders and finance professionals who strive to achieve excellence in their careers.

Featured links

Connect with us

Copyright © 2026