These are all the steps I followed myself, while developing my discretionary price action trading skills:

1. Watch Dr Brooks trading course videos actively (pause and think through the concepts) enough times so that when you watch each video again you know exactly what he is going to say next and remember his tone and expressions.

2. Read Dr Brooks Trading Price Action books carefully. You can also expand your reading to other books by other authors on price action trading. For example, Bob Volman’s books that are mostly focused on Forex price action trading are also good, but still, even if you’ve read those or other books, I would recommend reading Dr Brooks’ books as well.

3. For each concept, go to your charts and try to find as many examples as you can on your own. Patterns are similar in energy but slightly different in appearance each time they form. You must see lots of examples to get comfortable with the nuances, so that you can trust your judgement when the chart is alive and there is no time for detailed analysis. I think the breakthrough threshold is having done detailed analysis on about 2000 - 3000 charts. It is about 10 years of intraday price action, assuming 250 trading days in a year.

4. Itemized learning: Learn each concept thoroughly. You should be able to explain why a setup works.

5. Link the concepts: Study how smaller patterns link together to form larger patterns. Again, the litmus test is being able to explain why.

6. Day structure: For example, you should be able to explain in detail:

a. Why the chart looks the way it does at the end of the day.

b. What happened in the AM session that resulted in how the PM session shaped up?

c. Why similar days have small differences.

d. How does location of price in higher time-frame charts affect the patterns of lower time-frame charts?

e. How do you trade each part of the day (the open, morning session, noon, afternoon session, into the close)?

7. Big picture analysis: Learn how to use the concepts you learned above to estimate where the index is going and form reasonable hypothesis which you can use to regulate your actions intraday.

8. Probability Analysis:

a. What constitutes a high probability setup?

b. What are the details to look for to estimate the probability of a setup?

c. How to monitor for shifts in probability?

d. What changes your estimate as you see more bars added to the chart?

e. How do higher time-frame charts affect probability analysis of lower time-frame chart patterns?

9. Trade

Management: Once you can read the chart relatively well, focus on becoming

an expert in trade management. You must be able to:

a. Frame the trade and decide on the risk-reward ratios within a few seconds, resulting in accepting or rejecting the setup.

b. Quickly decide on whether the entry is a stop or limit order trade.

c. Decide before entering a new position whether you will scale in or exit quickly if the trade does not work out as expected. This means, you formulate your plan of action for the trade you are about to enter, in your head within a few seconds.

10.

Write it

down: take notes and organize them in a journal so that you can review and

reinforce your learning:

a. Intraday Notes: If you day trade, take quick and dirty notes. Just write down what crossed your mind somewhere, so that you can review and think about it later and decide if it is worth adding to your journal, or whether it needs further study.

b. End of Day: At the end of the day, take notes after your work is over.

c. Periodic: At the end of each period (could be a week, month, quarter, etc.) take notes. Review your work to align your actions for the next period to stay on target.

d. Review: A journal is not worth much if you never read it again.

11. Practice your skills: print the chart at the end of the day and find all possible trades on it. Do this every day for as long as necessary until you have formed habits and automatic responses (usually 5 – 10 years).

a. Computer

simulation: can be used to build and enhance skills, if done

professionally. More on this subject later.

12.

Position Sizing: Learn position sizing to understand what you should do to avoid blowing your account. This is also part of your trade management routine.

13. Speed up: Work on reducing your decision-making time to 10 – 15 seconds or less.

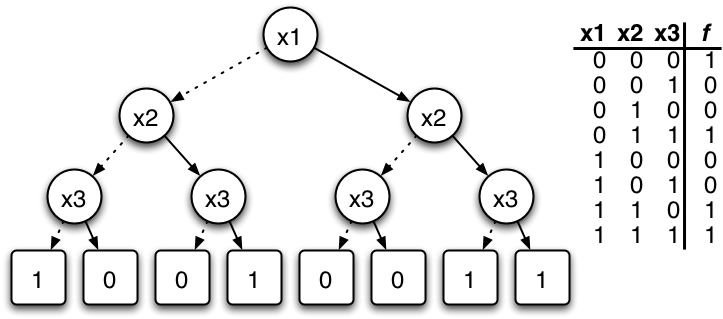

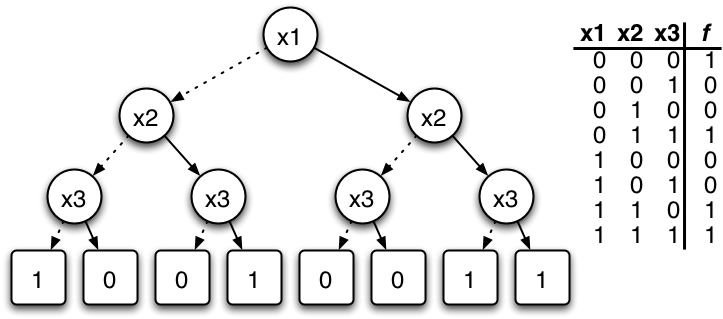

14. Automate your decision-making process:

a. Formulate your process in a binary decision tree so that each node has only two choices.

b. Rehearse your process so that you meet the above time requirement.

Binary Decision Tree: Each Node in a binary decision tree has only two possible choices

Image courtesy of Wikipedia

15.

Make mistakes: Trade and make mistakes without worrying about it. Know that you learn best by responsibly making every possible mistake. “Responsibly” means you do your best to trade well but if you make a mistake, you go back to the review step and learn from it during your after-hours debriefing.

16. Identify your roadblocks: sometimes you need psychological help. Identify your mental state roadblocks as early as possible and seek out help. Issues can be: not taking trades, taking too many trades (over-trading), exiting too early or too late, not executing your plan, seeking excitement, feeling euphoria after a winning streak, self-blame in case of losses, etc.

17. Establish your routines: Everything you do as a trader is pre-planned, right down to documentation and back-office processes. This means you need a business plan that explains everything you do as a business owner who runs a trading business. Once it is fully established, review and revise the document every 6 months to one year.

a. Keeping healthy and happy should be one of your routines.

18. Seek and establish consistency: you must find your comfort zone so that you reliably make a minimum number of points almost every day regardless of what kind of price action the market gives you. More on “comfort zone” in the next section.

a. Usually, a trader becomes consistent when he can estimate probabilities well and avoids taking low probability setups.

b. However, a trader can consistently make money by doing the opposite (taking low probability trades).

c. You must be able to explain how both are possible and why you have chosen the approach of your choice.

19.

Increase your position size: once you are consistent in your results, increase your position size slowly to build up your account and achieve your financial goals.

20. Be humble: respect the market for its proficiency and awesome power. Respect the other side and know that they will do everything in their power to turn the trade around in order not to lose.

21. Be grateful: be grateful for the opportunity, the challenge of becoming a professional trader, and the opportunities the market presents to you on every bar. Recognize the importance of being grateful so that you stay energized while learning, take your profits when they are there, and your losses before they grow to a painful amount.

22. Add: Add to your knowledge by learning as much as you can about the markets, the economy, how things interact, etc.

23. Expand: Think of ways you can automate your processes. If you are ambitious enough, figure out ways to expand your work beyond yourself by starting a trading company and hiring people to work for you.

Steps 5 – 8: Are best learned if you can work with an experienced trader, trading together, or participate in good trading room such as Dr Brook’s trading room every day for about a year or so, followed by active analysis of the day after hours and going back to watch the room recorded video. I think the duration is important because it will expose you to how a trader thinks and changes his opinion as market conditions change over time. Traders trade the intraday chart based on expectations they form from what the higher time frames are doing. As the market changes on daily and weekly charts, expectations for what the five-minute chart will do, change as well.

Everyone is different. You should recognize your individuality and appreciate it as a trader, but you also need to figure what is right for you. You will be making more money easier when you operate in that domain.

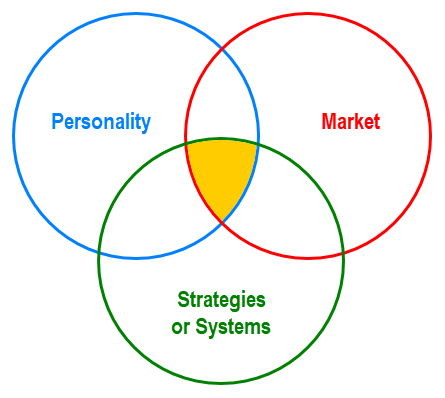

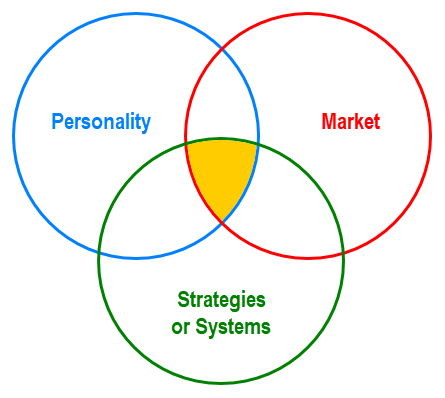

Your comfort zone is usually an area shared between your personality (your psychological makeup), skill level (strategies or trading systems you are implementing) and the market or markets that you trade.

For the first two, you need to understand yourself well and understand different strategies enough to choose the ones that are right for you. The best way is to try out as many as you like and monitor your emotions. The right strategies feel fun and effortless. Take a few of those and work on becoming an expert in executing them well.

Comfort Zone: Is the area shared by these three factors

The market you trade should be a good match with the other two factors. For example, crude oil often stays in trading ranges for many bars then has explosive moves, while the Emini S&P moves in a slower pace throughout the day. Emini NASDAQ on the other hand, moves quickly on almost every single 5-minute bar. For someone who can watch the slow bars and not get bored to catch the big move, crude oil is a great fit. For another person who likes lots of action and gets bored by slow markets, Emini NASDAQ is probably a better fit.

The market component goes beyond which market. For example, you might be in your comfort zone when the market is trending. In that case, you should avoid trading in trading ranges. The market component means two things: which market in what phase of the market cycle.

If you have attended Dr Brooks’ trading room, you have heard him say “you can sense…” the market wants to do this or that. For example, “You can sense the market does not want to go down.” One of my students recently emailed me, asking, “How can Al sense things in the market, but I can’t?” I replied, “sense” is Dr Brooks’ term for having lots of experience.

When you look at charts at the end of the day, you see static bars. About 20% to 30% of the information that the chart is providing as it is building it is missing, which is how the bars are forming – the energy of the market.

An experienced day trader has formed a comprehensive neural network of how the speed and size of fluctuations during bar formation relates to past price structures and contribute to the building of future ones.

I know this for a fact because I have validated the process through computer modeling. I have written algorithms that measure market’s energy on intraday charts and show the results on the chart using computer graphics. The model is very accurate in correctly anticipating which bars will have follow-through and provides reliable information on strong support and resistance, much more accurately than say, the market profile method. This is what an experienced trader “senses” when looking at a live chart. It gives him a mental picture for what is likely to follow.

So, part of becoming a good or intuitive trader is to watch live charts. Unfortunately, it is quite time consuming. A trader needs several years of attentive daily exposure to begin to understand market energy well enough to be useful.

Deliberate practice is essential for any performance-based activity, such as sports, arts, and trading. The difference between deliberate and other kinds of practice is that the practitioner sets incremental performance targets or milestones along the way when practicing deliberately. So, there is some planning involved.

A good way to plan your practice is to first decide what the things you want to trade are. Which setups you will be trading, what markets, timeframe, size of your risk capital, trade management details, etc.

There is a video on how to practice on this website, here:

For day trading, in addition to the above video, it helps if you replay the price action of the day in a simulator and practice your order entry and trade management tasks.

Day trading is a time-restrained activity. The trader must decide quickly and place orders without hesitation. Any activity that has such qualities requires developing some degree of motor skills. I used to use the market replay feature of the NinjaTrader platform for years when I was practicing. I believe it is the best simulator available and it is free, too.

Set measurable goals for your practice session. For example:

1. Day Type: any kind of trading range day (so you are excluding trend days that occur about 15% of the time). In other words, decide which phase of the market cycle you prefer to trade.

2. Setups: initially only one or two, for example, second entries and wedges. Note that setups you select must be a good match for the day type.

3. Discipline:

a. Take every good setup.

b. Execute cleanly.

c. Manage trades well: state your trade management goals

d. Do nothing else, even if obvious and enticing. Acknowledge it and say “pass”.

4. Tasks:

a. Diagnose day structure as early as possible.

b. Be open to change, if the price action of the day changes you recognize it early and adapt.

c. Identify the setup quickly: 10 seconds or less – see next section for details.

d. Decide on setup strength within that 10 seconds

e. Order entry: Based on signal bar’s price and context, decide on entry price with 2 to 5 seconds and click in the order.

f. If the order is not filled, decide within a few seconds to cancel the order, or change its price to get a quick fill.

g. Surprises: If surprised decide what to do based on the energy of the surprise:

i. Big favorable surprise: hold and add on. For example, convert a scalp to a swing trade.

ii. Favorable surprise: hold longer to exit with a bigger profit. For example, move your exit order from a 3-point profit to a 5-point profit.

iii. Negative surprise (or disappointment): hold or exit, if holding reduce exit target to get out with a smaller profit, such as converting a swing trade to a scalp.

iv. Big negative surprise: exit at the market without hesitation.

h. Conduct CEP (Continuous Estimation Process): once in the trade continue evaluating as new information come in (new bars, new ticks) and respond accordingly. Think and add your own steps to define what CEP is for you.

i. Exit: List all tasks that get you out of a trade and support your trading plan.

5. Mental state: work on clarifying the required mental state that supports each task you have listed. For example, for identifying setups quickly you probably must be present, centered, observant, open, confident, and calm.

6. Review and reflection: following your practice session you must review your work and score yourself on each activity. Excel is great for keeping debriefing records and makes it easy to create progress graphs of how you are improving over time. You will use your debriefing information to plan and improve your future practice sessions.

7. Correct and improve by deciding what needs to be fixed and focus on addressing them in the next customized practice session.

It is important to plan these sessions well and follow your plan. It is a lot of work, but it is the fastest way that I know to build and improve trading skills. After over a decade of trading, I still document my work at the end of the day and decide what needs deliberate practice.

You move each developed skill from simulator to limited production once it meets the criteria you have set for quality. Think of a trading skill as a prototype product. In limited production, you trade live but at the smallest position size possible. The steps are the same ones you devised for your deliberate practice, but they are now performed in the live market with real dollars on the line. It could be one micro-Emini S&P, when your routine size is 2 Emini S&P contracts, so 1/20th the size. Once you are happy with the performance of your prototype, it gets the go-ahead for production, and you move that skill to the repertoire of things you are allowed to do when trading live at the position size you typically trade.

It is critically important to understand the difference between a signal and a setup.

- Price action imbalance between price and value.

- Usually requires more than one bar to “set up”.

- Signal or Signal Bar (SB) is the final bar of a setup that makes you believe it is time to enter a new trade.

- It helps you identify the correct price to place your order at.

- SB qualities, as they relate to the setup, create precision in taking an entry.

- SB defines how a setup fails or succeeds.

- A SB is often also the transition point between two price structures.

- SB is the basis of the “Trigger” concept. Without a SB, trigger is meaningless.

- SB also refers to bars marked by a computer algorithm as trading signals.

A setup does not trigger, but a signal bar does. If a trader points to a chart says, “I will buy in this area” and cannot explain where exactly he would place his order and why, it means he has no idea about the relationship between setups and signal bars. Professional traders use the above definitions to decide on the exact entry price (right down to a tick), which makes the difference between consistent clean execution and haphazard trading.

Trading is a luxury career. Like all luxuries, it is not inexpensive, but the value is worth the price. It will help you stay focused once you recognize what a unique and privileged position you are putting yourself into, as a professional trader. So, treat your work as such. Do quality work. Nothing is insignificant or unimportant in this business.

Becoming a professional price action trader is like going through a PhD course of study; you know the start date but there is no foreseeable end date because it all depends on your supervising professor and your ability to satisfy him or her that you have become a true expert and earned your degree. For a few students it takes two years or less, for most six or more, and for some even 10+ years to finish, if there is a finish line. In performance fields, trading included, there is no last step of the ladder. The ladder is endless, and you constantly go higher up with each day under your belt during which you practiced your art well.