Systems Academy

-

Systematic Trading

-

1 Year

Write your awesome label here.

Course overview

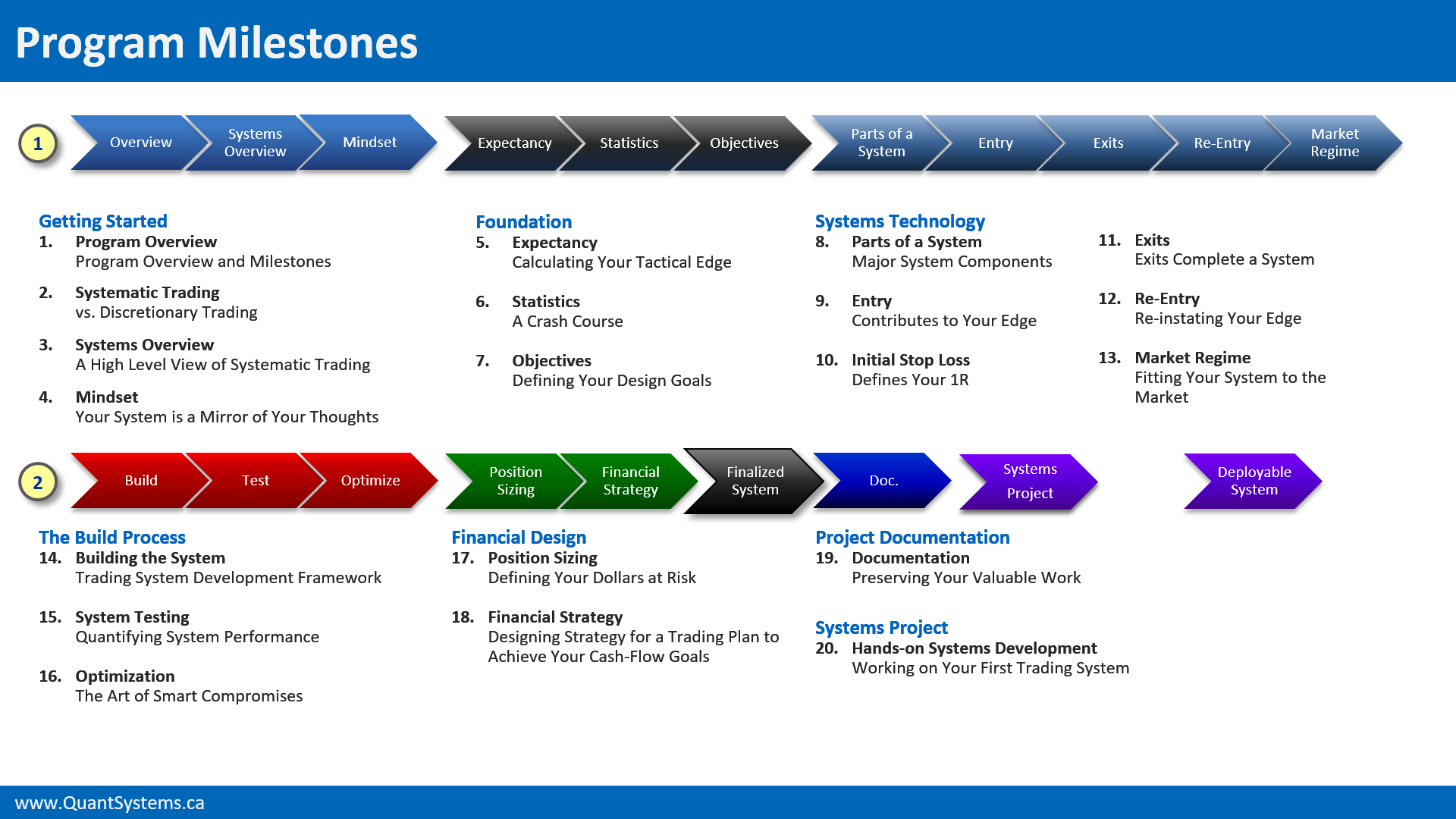

Systems Academy program is a comprehensive course on system design that includes a one year group coaching live weekly session over Zoom and hands-on systems development project. This program is intended for intermediate to advance traders who wish to take their knowledge to the next level by learning institutional grade skills.

-

Video time: 30 Hrs

-

Group Coaching: 1 Year

-

Hands-on Project: Supervised

-

Frameworks and Templates

-

TradeStation Code

What's included?

-

20 Chapters

-

66 Lessons

-

30 Hours of Videos

-

Course Notes Downloads

-

6 Example Systems

-

Code Examples for TradeStation and MultiCharts

-

Templates & Frameworks

Become a Systematic Trader

You will learn how to develop, organize and implement a trading system based on one of the core market theory principals, how to test and optimize it, and how to prepare your system for live trading.

Learn Institutional Skills

You will also learn how to design robust risk management methods for your systems and how to add position sizing and financial strategy layers to achieve your financial goals through systematic trading.

Ali Moin-Afshari

Systematic Trader

ABOUT ALI

Ali Moin-Afshari is the founder of Quant Systems and course creator of the Systems Academy program. He has had a successful +20-year career in IT and telecom, working as an architect, consultant, and founder of two IT companies. He began his trading career initially as a side business in 2007 and became a full time trader in 2014. He is a systems expert and has designed, developed, and programed more than 200 trading systems.

Introduction

Top 10 Problems

Solved Through Systematic Trading

Systems Academy Program Goal

Systems Academy Program

Format

What is Included

Who is Systems Academy for?

Student's Success Criteria

The Admission Process

Who are the Coaches?

How does a Systematic Trader Think and Work?

How is a System Developed and Tested?

Frequently Asked Questions

Who has gone through this program before?

We have only offered this training once before to a private group of investors who paid three time more for it than the price we are currently offering the program.

What if I cannot finish the program in 1 year?

You will not lose access to your course material and bonuses. At that point, you have the option of extending your coaching by purchasing extensions.

Do I need to travel?

Absolutely not. We work remotely with students all over the world.

Do I need to know computer programming?

No, but if you already know computer programming, we can help answer your questions. We encourage everyone to at least develop their first system using other computation methods, such as Excel to gain a deeper understanding.

Do I need to have a strong math background?

No, but you must be comfortable with high school level math. We have made the process as simple as possible without heavy math, but you must be able to solve simple equations and read simple math notation.

Do I have to know statistics?

No. We prefer a very basic familiarity with general probability concepts such as the bell curve, but Systems Academy program covers everything that is needed including a module on statistical topics that are directly used in systems testing. We have streamlined and simplified the process so that you don’t have to learn heavy statistics.

How much time do I need to have?

It depends on your background, education, and experience, but in general you should be able to dedicate at least 10 hours a week for one year, possibly more.

What kind of performance should I expect from a trading system?

It depends on the system and your objectives. There are systems that win 70% or more and generate a lot of trades, and on the other hand, there are systems that win 40% of less and keep you in a trade for months. We will work with you to find what is right for the trader who you are, so that you can reliably and comfortably trade the system that you build.

How much capital is recommended?

Considering the time and effort you will put into this program, you will most likely have a six figure trading (or retirement) account, to be worth your investment. We have had students who trade five figure accounts but that is mostly for learning and building experience.

How long does it take to become a systematic trader?

It depends on your educational background, experience, and time and effort you put into learning these skills. It also depends on what you want to achieve. For example, one of the systems Ali has developed, took him five years and only the signal generator part went from 250 lines of code in version 1 to over 4000 in version 34, but that is an institutional grade system and one that is built on unconventional methods, so it needed extensive research and new technology development. In general, you should be able to gain a good grasp of the skills after completing a few systems projects on your own, which typically takes about 1 to 2 years or so.

What is the greatest challenge in this work?

It is understanding who you really are as a trader and what your true limits are. For example, someone might think they are OK with a system that produces 21% drawdowns but makes 55% profits a year, only to find out that after a 10% drawdown they are so nervous that they can’t execute on systems signals.

How many systems do I need to develop?

In general you need at least three non-correlated systems to get a smooth equity curve. We recommend 4 to 6 however, if you are a fully systematic swing trader, that work as a portfolio of systems that manage your portfolio of assets. If you are a day trader, you will need at least two non-correlated systems.

How much work is there once I have my portfolio of systems?

It depends on the nature and number of systems in the portfolio. A day trading system is obviously very involved, but a group of systems that work on daily bars generally need about 15 to 30 minutes of your time per day and about 2 hours during the weekend to prepare for the new week. This is assuming you stop the development work and only run those systems.

Can I just get your systems and start trading them?

We do not recommend it. Numerous studies and trials have shown that traders can trade the system they have developed themselves better than someone else’s system. It is theoretically possible, but you will likely find that your psychology gets in the way of proper execution of systems developed by someone else and ruins the system’s edge due to all kinds of mistakes.

Why is systematic trading important?

It is the “one thing” that makes the difference between consistent long-term success and inconsistent results. It is the skillset that enables the trader to reduce their chance of ruin to an infinitesimally small value (practically almost zero) while maximizing the return on their edge. Most traders do not understand this concept and even when they do, they do not know how to implement it.