Chart Archive

-

Research Reference

Write your awesome label here.

overview

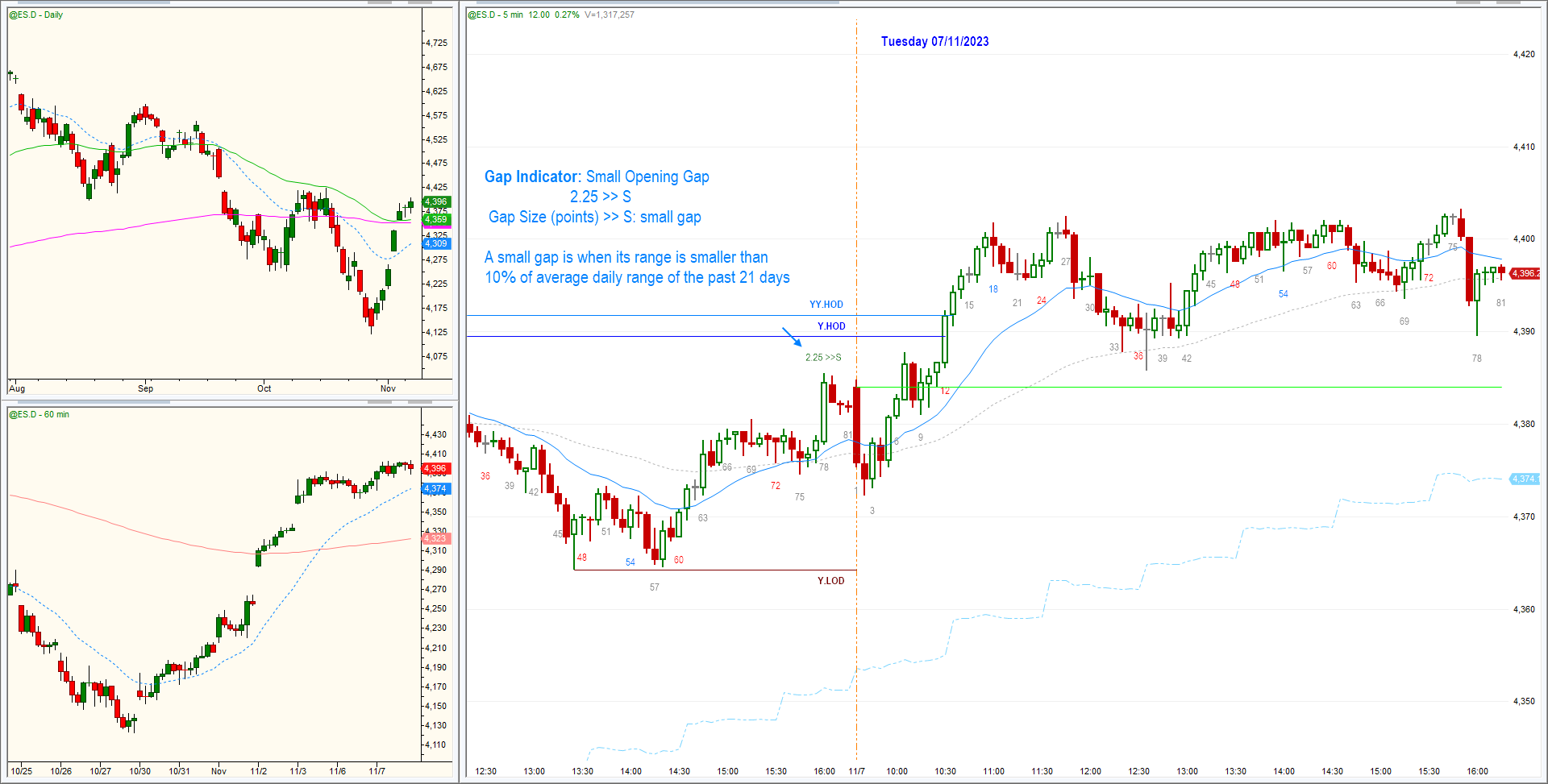

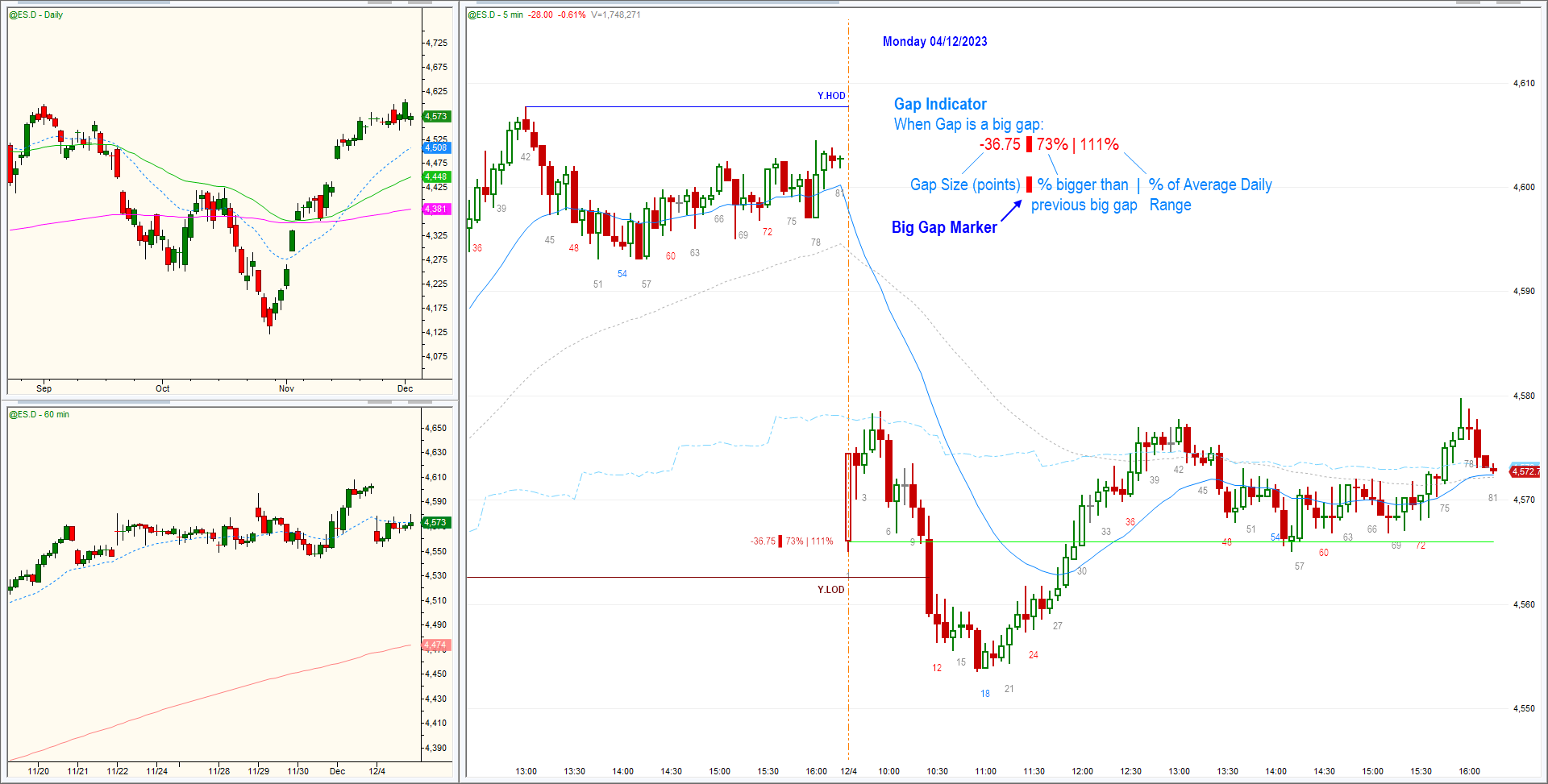

This module contains historical 5 min intraday charts of ES from Ali's archive:

-

2015: 241 charts

-

2016: 256 charts

-

2017: 251 charts

-

2018: 254 charts

-

2019: 253 charts

-

2020: 255 charts

-

2021: 253 charts

-

2022: 249 charts

-

2023: 248 charts

-

2024: 250 charts

Format

Indicators

File Name Convention

Chart Archive

Use your downtime productively

Write your awesome label here.

How to Use this Archive

Note on this Archive

Ali Moin-Afshari

Systematic Trader

ABOUT ALI

Ali Moin-Afshari is the founder of Quant Systems and course creator of the Systems Academy program. He has had a successful +20-year career in IT and telecom, working as an architect, consultant, and founder of two IT companies. He began his trading career initially as a side business in 2007 and became a full time trader in 2014. He is a systems expert and has designed, developed, and programed more than 200 trading systems.