Write your awesome label here.

Trader Development

Overcoming Overwhelm

Ankit Khound

How I overcame the overwhelming feeling while learning price action to become a successful fulltime trader

Published: August 16, 2023

Some Background about My Journey

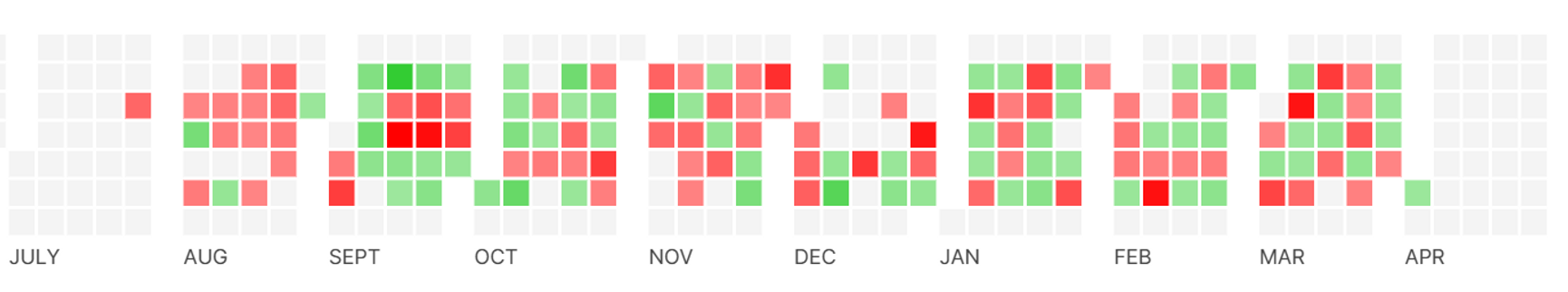

The image below shows what a blown account looks like. Red boxes represent losing days. It was the period from August 2021, when I first started trading, till March 2022. This is the P&L (profit and loss) colored chart from my early days and by the end of this period, I blew up my first account. After this, I took a break at the beginning of April 22 and then started exploring more resources, to learn more about price action.

A major turning point in my trading career came in the summer of 2022, June 17, 2022, to be precise. On this day I bought the Brooks Trading Course. After going through part 1 of the course twice, I began exploring the BTC website and found the Telegram group for traders who are in the course. It was in this group that Faizal mentioned that Ali is willing to start a mentorship group. It was mid-July 2022.

At this point, I had already seen Faizal’s podcast where he spoke to Ali. I immediately decided to join the Mentorship. It was the best decision I made in my trading career till now, as I will find out later on.

OK, I have mentioned a lot of dates, my apologies for that. But, I assure you, you will see more dates below. These dates will help you get an idea of the timeline of my developmental journey as a trader.

A few months into the Mentorship Program

When you start something new, it is always exciting, and it was for me too. The idea of coding price action was another interesting endeavor for me, prior to that I thought coding was used only to make indicators like RSI, MACD, etc. We started with a simple breakout code that Ali shared with us. That code was written in Easy-Language and I was using TradingView where the language is Pinescript, so that was another issue. But I got help from my fellow traders, who helped me understand the Easy-Language code and then to translate the code into Pinescript.

Another roadblock for me was in understanding new price action ideas. Someone rightly said, “Knowledge has a compounding effect”, that is, new knowledge can be acquired faster if you have prior knowledge about a topic and other related topics. I definitely lacked there as I didn’t have a proper framework of price action in my mind at that point and the early sessions were mostly based on the questions we asked, so it wasn’t ordered like it has been after the reset. For me, it was kind of learning a chapter in a book by going through the questions first, instead of reading the chapter. It wasn’t long before I started feeling overwhelmed by all the ideas Ali shared in the sessions. There was too much to learn.

Reaching out to my Mentor

It was in November 2022, when I was on the verge of blowing up my second account, that I stopped trading for the second time. It was the lowest point in my career. Being there, you start to question your abilities and if you can actually become a successful trader.

During that time, I badly needed advice on how to make things better. So, I approached Ali on November 20th and shared with him everything I was going through. He asked me how long I have been trading, and when I said it has been just 7 months since I bought Al Brooks’ course, he said it is quite normal to feel overwhelmed. I am quoting a few words from him here.

At the beginning we are faced with an ocean of information that it not too deep, I mean each item is easy to understand, but there are a lot of them which also balloon to a lot more combinations and nuances. It takes time and effort to get good with price action trading and that is usually after the point that the overwhelm is over.

"At the beginning we are faced with an ocean of information that it not too deep, I mean each item is easy to understand, but there are a lot of them which also balloon to a lot more combinations and nuances. It takes time and effort to get good with price action trading and that is usually after the point that the overwhelm is over. "

- Ali

- Ali

He understood exactly where I was and his words were kind of a relief for me, because when you know that it is alright to feel the way you do, you no longer worry about being there. I realized that I just need to keep going and do the work he asked us to do.

The first thing he asked me to do was to practice finding all possible trades on charts at the end of the day or by using past charts. This task helped me a lot as I will explain later on.

Slow Progress

After having the chat with Ali, I was much more relaxed already because he assured me that it does make sense eventually, but it takes some time and continued efforts on your part. I always prefer analogies and for this situation I realized that I am on an assembly line at a certain stage of the trader manufacturing process. It might take weeks or months, but I will get there.

I went ahead and started planning for how I would improve myself and after a few days of work I came up with a few ideas, along with the advice of marking trades by Ali.

1. Watching previous sessions repeatedly

To start with, I began watching the previous sessions repeatedly. And slowly I got comfortable with the ideas being shared by Ali, all the while trying to guess what he is going to say about the next thing on the chart (this was shared by Ali in his article on the BTC website).

With enough repetitions things started to make a lot more sense than they did in the beginning. I have probably watched all the sessions at least 3 times. And when you watch a session multiple times, you find more and more information within it because Ali shares so many ideas at once that it is not usually possible to understand them if you just watch the session just once.

When you get comfortable enough, you can start making notes on the ideas he shared.

2. Marking trades on charts

Finding all possible trades, as suggested by Ali, seemed like a daunting task for me at that time. So, I started with the bare minimum possible version of that task. I just marked one possible trade each day to start with and I focused on finding reasons for market to form a possible swing point(both major and minor) on the static chart at the end of day.

Just for reference I have added these annotated charts, as you can see sometimes I could find just 2-3 reasons and it would go up to six for some. If I remember correctly, my highest score for this task is around 8 reasons which included higher timeframe context too.

I did this for many weeks, and maybe months. When I got comfortable with finding one trade, I started marking two trades and so on. Because things repeat in the market, you won't be missing out even if you do 2. When I started to see many repetitions, I stopped documenting them. I still do this whenever I am not trading.

Just as a sidenote, there was a point when I even started to see charts in my dreams, I am not kidding! It’s a proof that your subconscious mind has kicked in and you have done a lot of thinking about charts during the day.

3. Developing a method for studying the content shared

I realized pretty early that there is a lot to learn as a beginner and so, without a proper documenting system, it will soon become overwhelming as you cannot remember where Ali discussed which topic when you need to refer a previous session’s video.

"You really have to document everything if you want to learn, and have good documentations."

- Ali (PTM 1, July 23, 2022, 1:07:06

- Ali (PTM 1, July 23, 2022, 1:07:06

Considering all that, I developed a pretty extensive workflow using different software to digest the information shared by Ali in each session. I still use it, although the process has had many updates and modifications.

In short it is like this. Get the transcript for the session. Watch the session again, mark important points, annotate the charts explained by taking screenshots and mark the tasks Ali suggested (I used to find 20-25 tasks in the early sessions. It's much less nowadays, because some of the new ones are already documented). Afterwards, I collect all of the markings in another app, like a mind-map or network notes app, and try to make sense of the ideas. I will try to write out my whole process in the near future.

So where I am Today

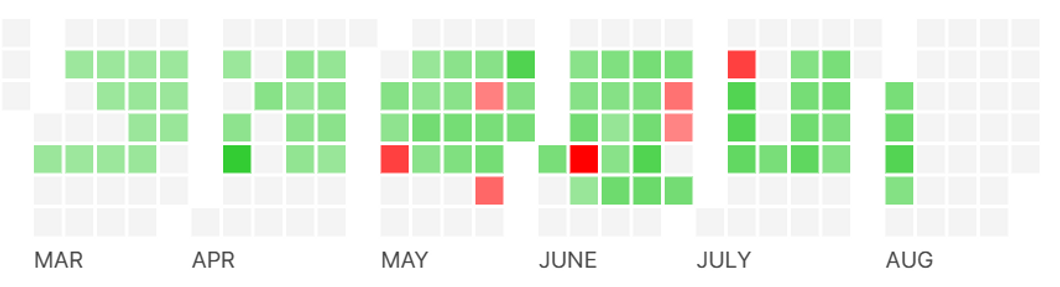

If you remember the colored P&L chart I shared at the beginning of this article, you can compare it to how it looks like today (March - August 2023). It certainly has lot more green boxes than red ones.

This picture alone doesn’t talk about all the minor flaws and knowledge gaps I still have in my price action knowledge, but at least it assures me that I can become a successful trader one day. I am still fine tuning my trading, one problem at a time.

I am still learning and have a long way to go. But I am much more comfortable today with price action and have seen it materialize in my trading. And I have “been there and done that” as a beginner and now sharing my journey with you, hoping that I might be able to address some of the issues you are facing.

My Message to the People Starting Out

If you look at a game of chess and don’t know anything about the game, at first you will just see the board with many boxes drawn on it and the differently shaped pieces. You might not understand how the pieces are moving. Then, you start learning how each piece can move and only after that you will be able to figure out strategies to deploy during the game based on the moves of your opponent. Learning about price action closes relates to this journey, in my opinion.

I think the major difficulties traders, starting out, face while learning price action is because everything is related to everything. So, until you have been exposed to enough of the material, things don’t make much sense.

Let me take the example of gap rejection. When there is a gap-up open and the first bar is a “nice” bear bar, then it is said that the market rejected the gap. But if you look closely, the gap can be replaced with a trend bar. Now, the trend bar will most probably be breaking out of something, so next we need a follow-through, but instead, we got a bear bar i.e. the breakout doesn’t have a follow-through and thus the gap created by the gap open trend bar got rejected on the next bar because there were sellers at the close or above that bar. As you can see, gap rejection is a pretty simple idea if you relate it with breakout and follow-through.

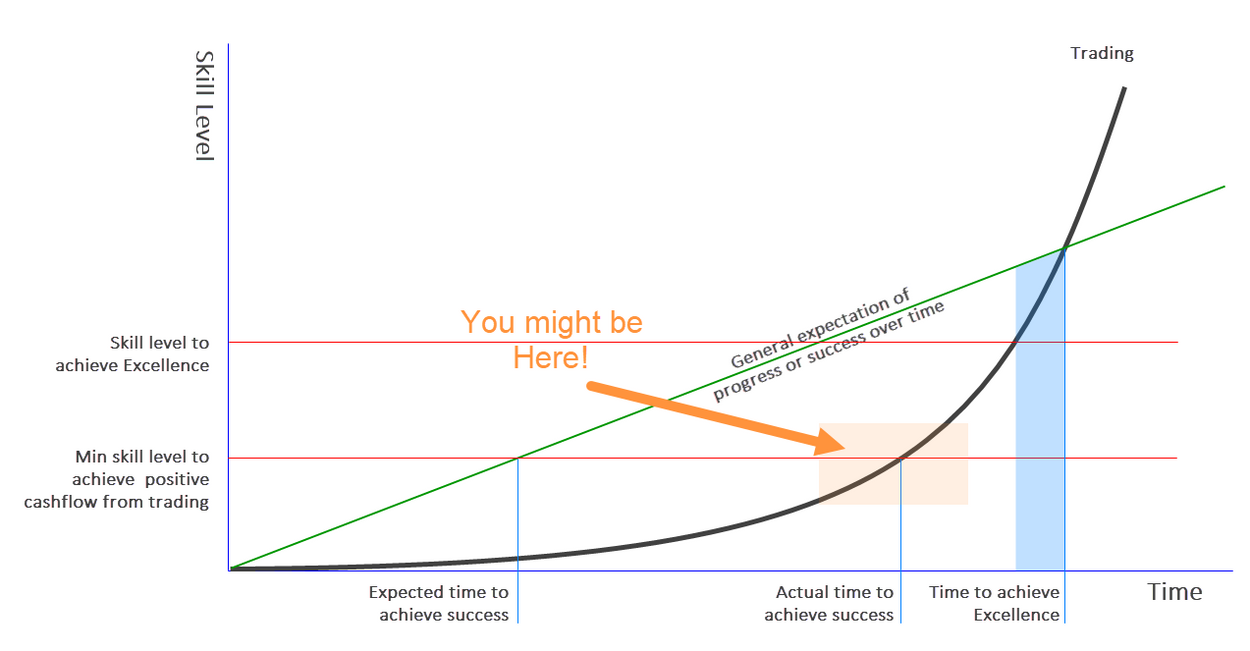

This graph was first shared with us by Ali (slightly annotated by me) in an email dated August 19, 2022. He also shared the same in subsequent PTM sessions. It is a depiction of how the skill level of a trader improves over time. The amount of time you put into learning price action is not proportional to the skill level you achieve, it’s actually exponential. So, in the beginning, it is hard to notice any improvement.

One day you will wake up and realize where you have reached, and when you look back, you may not be able to pinpoint where it all started to change, but you will know that you have crossed the threshold.

I will end this article with a quote from Steve Jobs that I relate to very strongly.

“If you really look closely, most overnight successes took a long time.”

- Steve Jobs.

I will end this article with a quote from Steve Jobs that I relate to very strongly.

“If you really look closely, most overnight successes took a long time.”

- Steve Jobs.

Ankit Khound

Full-time Professional Trader

ABOUT Ankit

Ankit Khound is a full-time trader from Jorhat, Assam, India. He has a background in Mechanical Engineering and a keen interest in coding. Trading in the Indian markets, he uses options for scalping in the Indian market indices NIFTY and BANK NIFTY.

Who we are

We are active professional traders committed to producing effective and high quality educational material for intermediate to advanced traders and finance professionals who strive to achieve excellence in their careers.

Featured links

Connect with us

Copyright © 2026